In two steps to the German SPV

We, TSI Services GmbH, have been providing German SPVs under German law since 2005. In more than 160 transactions, domestic and foreign originators have already used a German SPV to settle their securitisation transaction.

The provision of a German SPV via TSI is an established standard in the market, which is well known to all regulatory authorities, the ECB and all other market participants.

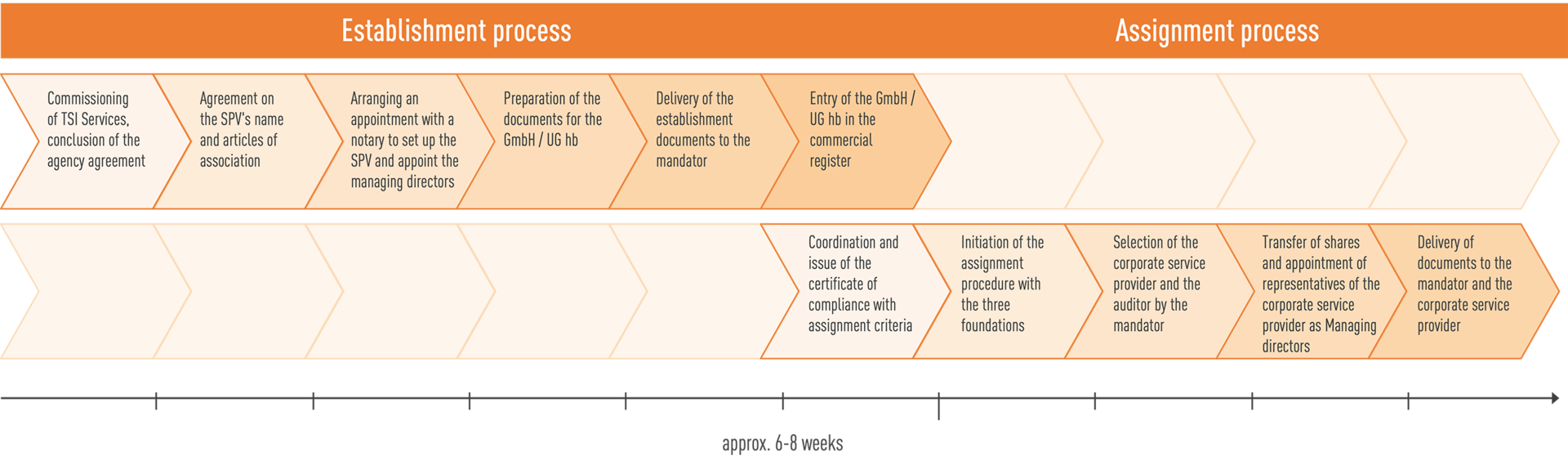

The provision is divided into two phases:

1. Commissioning of TSI Services and conclusion of the agency agreement

The foundation phase starts with the conclusion of the agency agreement. The agency agreement is concluded between the client and TSI Services. As a rule, it includes the mandate for the provision as well as the liquidation of the SPV after completion of the transaction. After TSI Services has been commissioned, the client receives a short project plan in which all steps up to the final provision of the SPV are documented, so that it can safely and reliably take the provision of the SPV into account in its transaction planning.

3. Notarial deed on the foundation and appointment of the SPV's managing directors

The SPV is established by notarial deed. Two managing directors of TSI Services are appointed as managing directors of the SPV. This has the following advantages for the client:

- There are no costs for a corporate services provider during the foundation phase and

- the tax number, as a prerequisite for issuing the binding information from the tax authorities, can be issued more quickly.

The founding partner is TSI Services, which, in the second step of the sub-foundation, distributes its shares to the three non-profit foundations (see step 6).

6. Coordinating and issuing of the certificate of endowment and initiation of the endowment procedure

In the second phase, known as the endowment phase, the shares of the SPV are transferred by TSI Services to the three non-profit foundations of the TSI securitisation platform. This requires the issuance of a certificate of endowment for each foundation by the originator. TSI Services assists in the preparation of the necessary documents, coordinates the entire coordination process with the foundations and obtains the necessary powers of attorney and resolutions.

8. Transfer of company shares and appointment of corporate services providers as managing directors

9. Handover of documents to client and corporate services provider and provision of German SPV

Liquidation of the SPV via TSI Services – simple and efficient

In order to be able to wind up the SPV cost-efficiently after the end of the transaction, TSI Services already offers the liquidation of the SPV upon conclusion of the agency agreement. In this context, TSI Services provides the liquidators for the SPV and manages the liquidation throughout the entire process until the SPV is finally wound up (duration: approx. 18 months).