Events overview

Quality plays a central role not only in the standards for securitisations for TSI. We apply the same principle in our diverse training and event programme which reaches well over 1,000 participants from all market sectors every year.

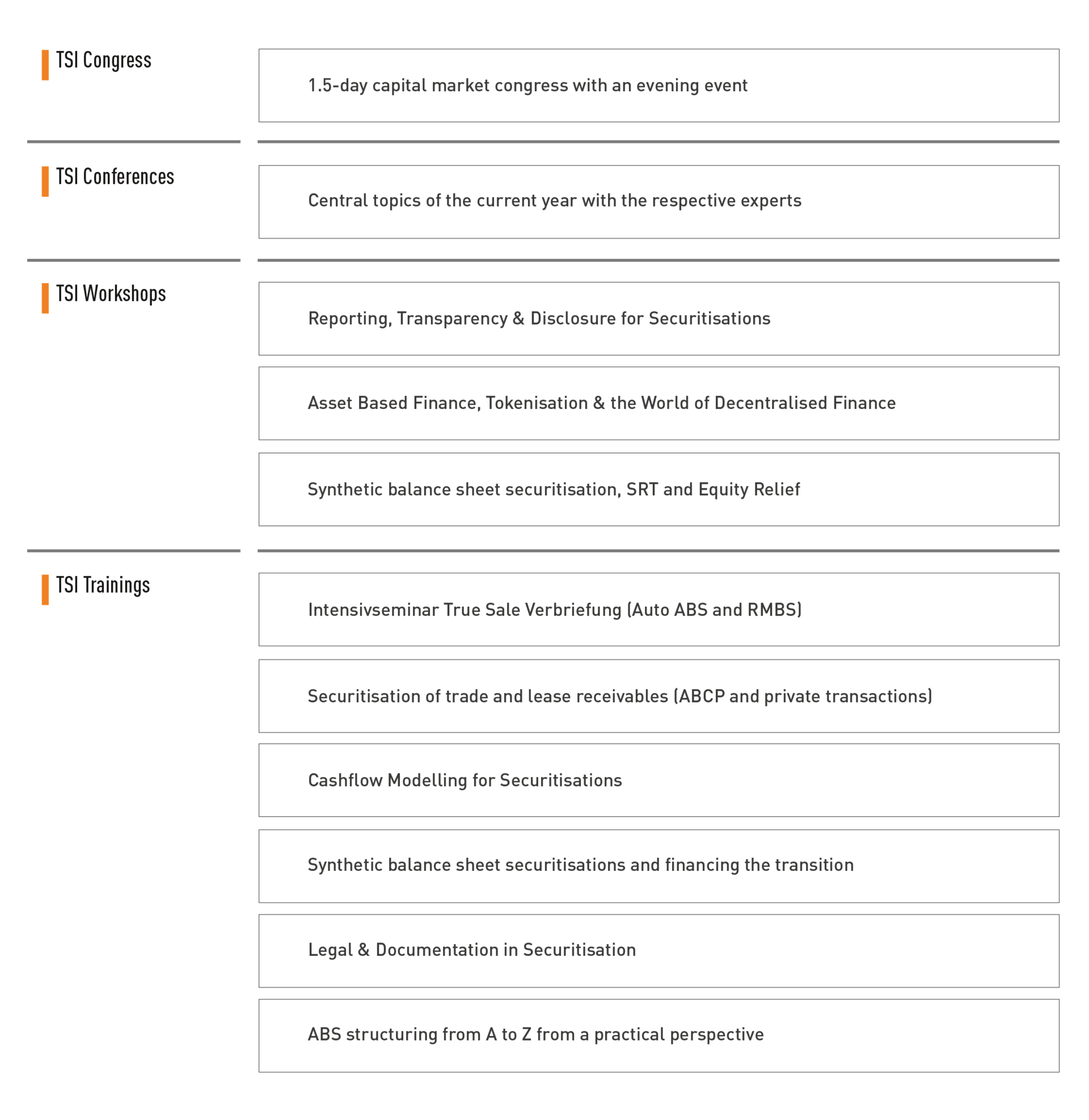

We prepare comprehensive securitisation know-how and related special topics for you, and with the content is delivered by high-calibre experts from the field. The formats we offer you range from established TSI training courses for beginners and advanced learners to workshops and conferences to the annual TSI Congress in Berlin. In this way, we provide a diverse platform for sharing ideas and information on current developments in the securitisation market and beyond.

The following overview is intended to help you select the events that suit your needs. It shows how our events are structured and which target groups they are aimed at.

TSI Training: Intensive Seminar True Sale Securitisation (Auto ABS and RMBS)

The ‘Intensive Seminar True Sale Securitisation (Auto ABS and RMBS)’ is the popular format for a well-founded introduction, consolidation and refreshment of knowledge around the topic of securitisation. The focus is on public ABS transactions in the key asset classes of Auto ABS and RMBS, but also relevant for those interested in consumer and leasing ABS. The established small group format with 10 to 15 participants offers the opportunity for intensive discussion and treatment of individual questions.

Target group: Professionals and managers in the financial sector who want to deal intensively with all important aspects of public securitisations.

Duration: 2 days

Format: onsite

TSI Training: Securitisation of trade and lease receivables (ABCP and private transactions)

The training course ‘Securitisation of trade and lease receivables (ABCP and private transactions)’ provides a comprehensive overview of the market, functioning and structures of securitisations of trade and lease receivables. The focus is on private securitisations that are financed via the bank balance sheet or ABCP programmes.

Target group: Employees of banks and companies involved in structured finance and securitisation, investors and transaction parties as well as risk managers and employees from regulatory authorities and auditing firms who want to get an up-to-date overview of what is happening in the market and transaction-related details.

Duration: 1 day

Format: onsite

TSI Training: Cash Flow Modelling for Securitisations

The course ‘Cash Flow Modelling for Securitisations’ introduces participants to the approaches of cash flow modelling of securitisations. The focus is on auto and consumer ABS as well as RMBS. The course follows a step-by-step approach to creating a complete cash flow model in Excel and includes an explanation of the different elements and various alternatives to typical structures.

Target group: The course is aimed at securitisation professionals such as originators, arrangers, investors, risk managers and securitisation transaction service providers who want to learn and understand cash flow modelling in a ‘boot camp’ environment.

Duration: 2 days

Format: onsite

TSI Training: Synthetic balance sheet securitisations and financing the transition

The course ‘Synthetic balance sheet securitisations and financing the transition’ offers a deep dive into the world of synthetics. The market for synthetic balance sheet securitisations has developed very dynamically in recent years. This is a result of changes in the regulatory framework and, above all, the increasing demand for financing from the economy and the accompanying increase in capital requirements for banks.

Target group: Specialists and managers from banks, insurance companies, asset management companies and other financial service providers who deal with the topics of securitisation, risk transfer and sustainable financing.

Duration: 1 day

Format: onsite

TSI Training: Legal & Documentation in Securitisation

The course ‘Legal & Documentation in Securitisation’ covers the essential legal principles and in-depth specialist knowledge for a profound analysis of securitisation transactions. The complexity of such projects requires a sound understanding of legal topics - from specific issues relating to the sale and transfer of receivables, to insolvency-proof structuring and the correct application of non-petition and limited recourse clauses. A particular focus is on the legal documentation that forms the basis of a successful transaction. .

Target group: The course is directed at both lawyers and non-lawyers who are involved in securitisation projects. It is particularly important for non-lawyers to recognise potential legal challenges at an early stage in order to involve the appropriate experts or solutions in the next step.

Participants will be able to make a valuable contribution to the secure and efficient structuring of securitisation transactions.

Duration: 1 day

Format: onsite

TSI Training: ABS structuring from A to Z from a practical perspective

The course ‘ABS structuring from A to Z from a practical perspective’ covers the question of how to structure a securitisation transaction from A-Z. Previous knowledge, for example from the 'Intensive Seminar True Sale Securitisation', is recommended.

Target group: Employees from the areas of structured finance, credit portfolio management, treasury and risk management. Lawyers, economists and analysts who are involved in structuring and analysing ABS transactions.

Participants who already have basic knowledge, for example from the 'Intensive Seminar True Sale Securitisation', and want to deepen their knowledge..

Duration: 1 day

Format: onsite

TSI workshops pick up on trends and current topics that offer new market opportunities, for example in the areas of Capital Markets Union, structured finance, sustainable finance and alternative credit transfer.

Target group: Professionals from banks and companies involved in structured finance, investors and transaction parties, representatives of law firms, auditing firms and employees of regulatory authorities and government departments.

Duration: 0.5 - 1 day (depending on the topic)

Format: onsite or online

TSI conferences address central topics of the current year and bring together the respective experts. In addition to providing expert information, we also want to support dialogue and formation of opinions among market participants.

Target group: These events are aimed at specialists and executives (senior level) from banks and companies dealing with structured finance, investors and transaction parties, representatives of law firms as well as employees of regulatory authorities, government departments and auditing companies.

Duration: 1 day

Format: onsite

The TSI Congress is a 1.5-day capital market congress with a pre-congress evening event. It takes place onsite in Berlin. Around 30 different panels, workshops and discussion forums take place over the 1.5 days, as well as further networking events in the evening and in the afternoon of the second day.

Target group: Specialists and executives, managing directors, partners and board members from the areas of credit and credit portfolio management, risk management, law and regulation, trading and treasury in banks. In addition, specialists from law firms, auditing companies and rating agencies, business services and management consulting firms as well as CFOs and treasurers of large companies in the real economy.

Duration: 1.5 days

Format: onsite